New ways and solutions to exchange money among people without using cash are recently booming. The ubiquity of smart devices, apps, relationships in social networks and opportunities opened by financial regulations are pushing startups and incumbents to offer simple, reliable and ready-to-go solutions to transfer money instantly and in digital form.

Human Highway and SSI have conducted a survey over a sample of 10,000 consumers in five main EU countries (Italy, France, Spain, Uk and Germany) to discover that:

- P2P online payment systems have a huge market: the segment of Internet users who had to settle a small debt with another person at least once in the last month has a penetration varying from 26% in Italy up to 59% in UK

- Cash is the most used system in all countries (from 58% of the settlements in Uk to 78% in Germany) while wire transfer through a bank covers from 12% to 19% of the cases in all countries but in Uk, where it jumps to 32,3%

- Usage of alternative digital methods is still very limited (less than 1%) and spread in a big variety of different apps and online solutions. There’s still no winner and still no market, even in the Uk (which is the quickest among all the five countries in adopting new solutions in the digital services)

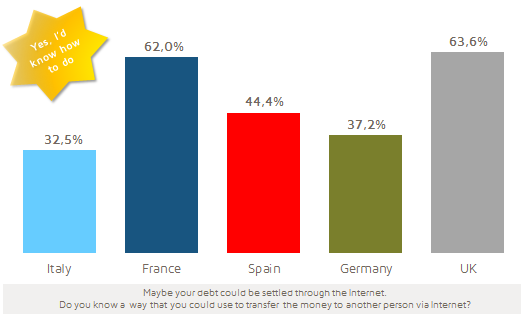

- Not all P2P debitors are aware and able to settle their debts in a cashless way. Only 33% of Italians say they could do it on the Internet (37% among Germans,44% among Spanish) while in France and Uk that segment is the majority (62 and 63%)

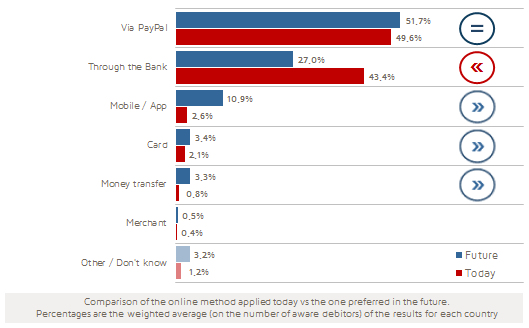

- There’s a latent incumbent in the P2P payment market: when P2P debitors are asked if they were able to settle their recent payment online, the spontaneous answers turned on to PayPal. PayPal’s share of mind as a P2P payment tool is very strong (above 50% of the spontaneous quotations in all market but Uk, where is drops to 36%) and higher than wire transfer in all five countries but Uk (where it still gets the attention of more than one user out of three)

The survey underlines a big difference between Italy on one side and Uk on the other, while the other three countries tend to represent the European average:

- in Italy three factors strongly affect the results: the relatively low penetration of Internet users in the population, the relatively low usage of online banking and online usage of credit cards and the wide presence of PostePay, a pre-paid card which can be used as an electronic wallet

- UK, on the other side, is far from the European average in terms of large adoption of online banking services (which puts PayPal under pressure) and a relatively high adoption of new mobile/App payment solutions: 3.4% of online people in the Uk could use such a solution today to settle all P2P payments, much higher than the average 1% in the other four EU countries

The future seems brighter for PayPal and new mobile solutions than for Banks. When looking at ways of settling a P2P debt in a cashless way in the future, people largely rely on PayPal and tend to leave the existing online banking services. Solutions based on Credit Cards are almost ignored by consumers. The “space of expectations” liberated by banks is filled by Mobile (NFC technologies, mobile wallets) or App solutions (Jiffy, PayM, PingIt and the likes but also Facebook, WeChat or Snapchat). Of course, there’s still an IBAN behind many of these tools but the concept of wire transfer is going to be completely reshaped.

As of today, the battle seems to be confined to two players: PayPal on one side and mobile solutions promoted by banks.